Are you considering making improvements to your home but are unsure about the financing options available to you? Whether it’s a long-awaited renovation or essential repairs, understanding how to finance your home improvements is crucial. In this comprehensive guide, we’ll explore the average cost of home improvements, as well as the seven best ways to finance them. From traditional home improvement loans to government-backed options, we’ll cover it all. By the end, you’ll have a clear understanding of the financing options at your disposal, allowing you to make informed decisions about your home improvement projects. So, let’s venture into the world of home improvement financing and equip ourselves with the knowledge needed to make your dream home a reality.

Key Takeaways:

- Save as much as you can before starting any home improvement project to reduce the amount you need to borrow.

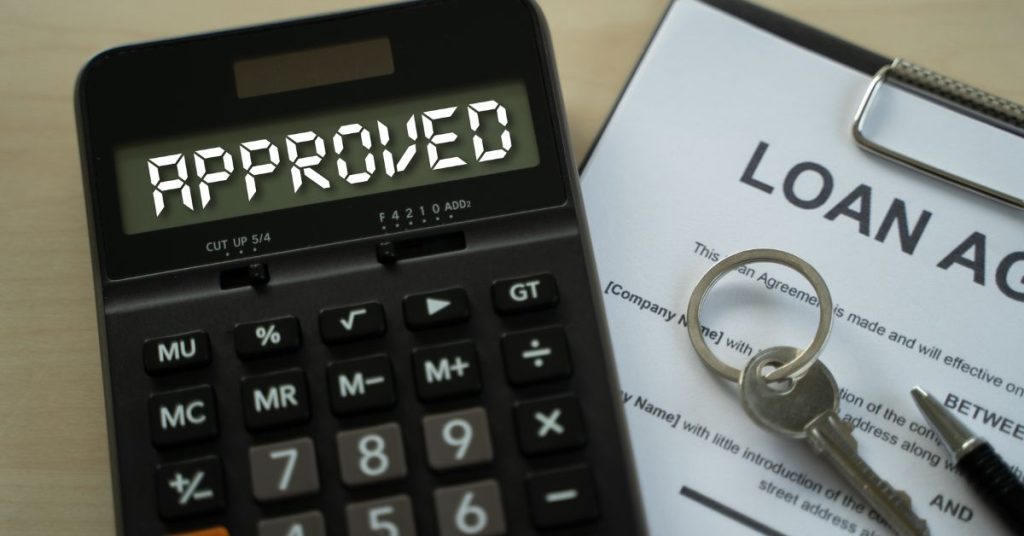

- Home improvement loans, HELOCs, and home equity loans are three common financing options with different terms and benefits.

- Be aware of your credit score and explore government loans if you have bad credit or need financing for emergency repairs.

Understanding Your Financing Options for Home Improvements

Understanding your financing options for Home Improvements is essential for homeowners looking to enhance their living spaces or address necessary repairs.

When considering home improvement projects, it’s crucial to explore various financing options to determine the most suitable choice for your specific needs. Homeowners can explore traditional options such as home improvement loans or lines of credit, which offer fixed or variable interest rates. Alternatively, seeking financial assistance through government grants or rebates can also be beneficial. Some homeowners may opt for a home equity loan or HELOC (Home Equity Line of Credit) to leverage the equity in their property to fund their improvement projects.

Advertiser Disclosure

Advertiser Disclosure provides transparency about the financial relationships between the website and its advertising partners, ensuring that consumers are aware of any sponsorships or paid promotions.

This transparency is essential as it helps consumers make informed decisions and fosters trust in the website and its content. By disclosing these relationships, the website demonstrates a commitment to providing authentic and unbiased information to its audience. It also enables consumers to understand the potential influence that advertising relationships may have on the content they are exposed to, thus enabling them to critically evaluate the information presented.

How We Make Money

How We Make Money outlines the revenue generation methods employed by the website, providing insight into the financial aspects of its operations and content creation.

One of the primary revenue generation strategies utilized by the website is advertising. This involves displaying ads from various advertisers, and the website earns revenue based on clicks, impressions, or other agreed-upon metrics. The website leverages affiliate partnerships to generate income, where it earns a commission for promoting and selling products or services from partner companies. The website may have other income sources such as sponsored content, selling digital products, or providing premium services, all contributing to its revenue model.

The Bankrate Promise

The Bankrate Promise signifies the commitment to delivering accurate, reliable, and unbiased financial information and resources to enable consumers in their decision-making processes.

This commitment is fundamental to Bankrate’s mission of promoting financial welfare and integrity. By upholding high ethical standards, Bankrate ensures that its guidance is always in the best interest of consumers. The promise reflects the dedication to transparency, honesty, and accountability in providing valuable insights on various financial products and services.

Average Cost of a Home Improvement

The Average Cost of a Home Improvement project varies depending on the scope, scale, and specific requirements, with considerations for materials, labor, and additional expenses.

Regarding material expenses, the cost can be significantly impacted by the quality and type of materials chosen. For example, hardwood flooring will generally have a higher price tag compared to laminate. In terms of labor costs, this can depend on the complexity of the project and the expertise of the professionals involved. Unexpected expenses such as permit fees and disposal costs also need to be factored into the overall project budget. These various factors contribute to the overall average cost of home improvement projects, making it essential for homeowners to carefully plan and budget for each aspect of their renovation or remodeling plans.

7 Best Ways to Finance Home Improvements

Exploring the 7 Best Ways to Finance Home Improvements offers valuable insights into effective financial strategies and options for homeowners seeking to renovate or upgrade their properties.

One popular financing method for home improvements is a home equity loan, which allows homeowners to borrow against the equity in their property. Another option is a personal loan, which offers flexibility and simplicity. For those with good credit, a credit card with a 0% introductory APR can be a viable solution. Some homeowners opt for a HELOC, a line of credit that can be used for various home improvement projects. Government programs, such as FHA Title I loans and energy-efficient mortgages, provide alternative ways to secure financing. Tapping into 401(k) savings or using a contractor’s financing program are potential options to consider.

Save

Saving is a fundamental approach to finance home improvements, enabling homeowners to accumulate funds and allocate resources for their renovation or repair projects.

By setting aside a portion of their income regularly, individuals can build a financial cushion for future home improvement needs. This prudent approach alleviates the need to rely on high-interest loans or credit cards, thereby minimizing the overall cost and avoiding debt accumulation.

Strategic financial planning enables homeowners to prioritize their renovation goals and execute them systematically, ensuring that essential upgrades are addressed without causing undue strain on their budget.

Home Improvement Loans

Home Improvement Loans provide accessible financial assistance for homeowners, offering dedicated funds for property enhancements or necessary repairs, with various terms and options available.

These loans offer the advantage of enabling homeowners to renovate or upgrade their properties without needing to pay the entire amount upfront. They can cover costs for remodeling, adding extensions, installing energy-efficient systems, or addressing structural issues.

Typically, homeowners can choose between secured and unsecured loans, and the repayment terms can be flexible, often spanning several years. While eligibility criteria vary among lenders, certain factors such as credit score, income, and property value are usually considered.

Borrowers can enjoy potential tax benefits and increased property value as a result of the improvements.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) presents a flexible and secured financing option for home improvements, leveraging the equity in the property to access funds as needed.

With a HELOC, homeowners can tap into the equity they have built up in their homes over time, providing access to a revolving line of credit. This means they can borrow against their equity repeatedly, making it an ideal solution for ongoing or long-term projects. HELOCs typically offer lower interest rates compared to other forms of financing, making it an attractive option for homeowners. It’s important to note that HELOCs require careful consideration as they are secured loans, using the home as collateral, and non-repayment could result in the loss of the property.

Property valuation is crucial in determining the maximum amount of funds that can be accessed through a HELOC. This is because the loan amount is contingent on the equity in the home, which is calculated based on current property valuation.

Home Equity Loan

A Home Equity Loan offers homeowners a lump sum amount based on their property’s equity, providing financial flexibility to undertake substantial home improvement projects or repairs.

Home equity loans typically offer lower interest rates compared to personal loans and credit cards, making them an attractive financing option for homeowners. The loan structure allows borrowers to access a large sum of money upfront, which can be beneficial for major renovations, additions, or repairs.

The interest rates on home equity loans are often fixed, providing predictability in monthly payments. This stability can be advantageous for budgeting purposes.

When considering a home equity loan, homeowners should assess their property’s current market value, as well as the outstanding mortgage balance. Lenders typically allow borrowers to access up to 85% of their home’s equity, but the specific amount may depend on individual financial circumstances and creditworthiness.

Cash-Out Refinance

Cash-out refinance allows homeowners to leverage their property’s equity by refinancing the mortgage for an amount exceeding the existing loan balance, providing substantial funds for home improvements or other financial needs.

By tapping into the accrued equity in their homes, homeowners can access considerable funds that can be used to renovate their property, increase its market value, or address pressing financial obligations. This financial strategy offers advantages such as lower interest rates and tax-deductible interest for qualified homeowners. It’s essential to carefully consider the long-term implications, including extended loan terms and associated fees, to ensure that the benefits of cash-out refinancing outweigh the potential drawbacks.

Credit Cards

Credit Cards offer a convenient but potentially costly method for financing home improvements, allowing homeowners to access immediate funds for renovation or repair projects.

While credit cards provide an accessible source of financing, they often come with higher interest rates compared to traditional loans. This could result in increased overall expenses for the home improvement project. The payment terms on credit cards can be less flexible, leading to potential challenges in managing and budgeting for repayments.

Utilizing credit cards for large-scale home improvements may impact an individual’s credit utilization ratio, potentially affecting their credit score. Careful consideration and comparison with other financing options, such as personal loans or home equity lines of credit, are essential to make an informed decision that aligns with long-term financial goals.

Government Loans

Government Loans, such as FHA or VA loans, provide accessible and affordable financing options for home improvements, catering to specific eligibility criteria and property improvement purposes.

These government-backed loans offer advantageous terms and competitive interest rates, making them an attractive choice for homeowners seeking to enhance their properties. To be eligible, applicants often need to meet certain income requirements and demonstrate that the funds will be used for approved improvements. Through FHA or VA loans, homeowners may access funds for crucial renovations, energy-efficient upgrades, or accessibility modifications, contributing to a more comfortable and sustainable living environment.

Financing for Emergency Home Repairs

Financing for Emergency Home Repairs addresses the immediate financial needs for unexpected property damages or crucial repairs, offering accessible solutions to homeowners facing urgent maintenance issues.

When dealing with unexpected home repairs, homeowners often find themselves needing quick access to funds to address the issues swiftly. In such situations, rapid financing methods like personal loans, home equity lines of credit, or credit cards can provide the necessary funding to cover the repair costs. Homeowners may also explore the option of filing insurance claims to offset the financial burden of emergency repairs. Other available sources of assistance, such as government grants or low-interest loans, can offer relief for those facing financial constraints due to unanticipated home damages.

Financing for Emergencies with Bad Credit

Financing for Emergencies with Bad Credit offers tailored solutions for homeowners with less-than-ideal credit scores, providing accessible financial pathways to address critical property repairs or damages.

These financing options are particularly beneficial for homeowners facing unexpected repair needs and struggling to secure traditional loans due to their poor credit history. Traditional lenders may reject applicants with bad credit, but specialized programs and lenders cater to these individuals, offering flexible terms and manageable interest rates. Homeowners must explore their options thoroughly and understand the eligibility criteria, repayment terms, and potential impact on their credit scores. Proper financial management and responsible borrowing can help homeowners navigate emergency repairs without worsening their credit standings.

Frequently Asked Questions

What financing options are available for home improvements at Master’s Home Solutions?

Master’s Home Solutions offers a variety of financing options for home improvements, including loans, credit cards, and payment plans. These options allow you to choose the option that best fits your budget and needs.

How can I apply for financing for my home improvements at Master’s Home Solutions?

Applying for financing at Master’s Home Solutions is easy. Simply fill out our online application or visit one of our showrooms to speak with a representative. We will work with you to find the best financing option for your project.

What are the benefits of financing my home improvements through Master’s Home Solutions?

Financing your home improvements through Master’s Home Solutions allows you to complete your project without having to pay the full amount upfront. This can help you manage your budget and make your project more affordable.

Can I use my own financing for home improvements at Master’s Home Solutions?

Yes, Master’s Home Solutions accepts outside financing options. If you have a preferred lender or financing plan, we can work with you to make the process as smooth as possible.

Are there any special promotions or discounts available for financing home improvements at Master’s Home Solutions?

Master’s Home Solutions occasionally offers special promotions or discounts for financing certain home improvement projects. Keep an eye on our website or social media channels for updates on any current offers.

Is there a minimum or maximum amount that I can finance for my home improvements at Master’s Home Solutions?

The minimum and maximum financing amounts vary depending on the specific financing option you choose. Our representatives can provide you with more information and help you determine the best option for your project.